Online Gambling Taxation

Instead, gambling operators must pay taxes, and online gambling site operators must pay UK gambling tax duty. In the United States, the tax rate owed on gambling winnings is a flat 25%. Gambling winnings are subject to withholding for federal income tax at a rate of 24% as of 2020 if you win more than $5,000 from sweepstakes, wagering pools, lotteries, or other wagering transactions, or anytime the winnings are at least 300 times the amount wagered. Gambling Income Tax Requirements for Nonresidents. Nonresidents can usually report income that is 'effectively connected' with a U.S. Business on Form 1040NR-EZ. Gambling winnings, however, are considered to be 'not effectively connected' and must generally be reported on Form 1040NR. Such income is generally taxed at a flat rate of 30%. (b) Gaming Tax – imposed solely on the betting revenue generated by the remote gaming company, the rates of which differ depending on the type of gaming license issued: In all cases, the total maximum tax payable per annum by one licensee in respect of one licence shall not exceed € 466,000 per annum.

- Online Gambling Tax Ireland

- Online Gambling Sites

- Online Gambling Taxation Advice

- Online Gambling Taxes

Gambling online and in brick-and-mortar establishments is a leisure activity for some – but for many, gambling is their profession. There is no shortage of professional poker players, sports bettors, bridge players and blackjack players out there making their living through gambling. Knowing about tax-laws and obligations as a gambler is essential, as mistakes can be very costly.

In some countries, gambling is 100% illegal. In countries where it is legal, there are regulations, rules & taxes to consider. In some countries and statres, casinos and betting establishments must obliged to pay tax on their profits, and in some cases, it is up to the individual to declare and pay taxes on their winnings.

International Tax Rates on Gambling Earnings

The biggest winners in the table are gamblers from the United Kingdom – with an effective tax rate of zero on ALL winnings,. This applies to all types of gambling—including poker, slots and casino games, lotteries, sports-betting & horse racing. Instead, gambling operators must pay taxes, and online gambling site operators must pay UK gambling tax duty.

In the United States, the tax rate owed on gambling winnings is a flat 25%. If you win big in Las Vegas at poker, the casino must withhold the 25% when collect your cashout, and provides you with IRS form W2-G to report your winnings to the government. Find out more on the IRS website.

Online Gambling Tax Ireland

Laws in Canada treat amateur and professional gamblers very differently for taxation purposes. According to the Income Tax Act, anyone in Canada winning a lottery prize or winning at a game of chance is not subject to income tax on those winnings. … In cases of sports betting, poker, or casino games and slots, winnings are also not liable for taxation – unless you are a professional gambler (as defined by paragraph 40(2)(f) of the Income Tax Act,). If you are , you must declare gambling winnings when you file your taxes and will be charged 26%.

Don’t get Yang-ed

Back in 2007, poker-player Jerry Yang topped 6,358 players at the World Series of Poker Main event, winning $8.25 million.

On a podcast, Yang admitted to bad financial management paying taxes of just $900,000 in California, and giving along with donations and gifts to family and friends. After bad financial advice he waa left with a huge federal tax bill. Subsequently the IRS seized the his Corum main event bracelet along with other jewelry to be auctioned off to the public in order to pay Yang’s outstanding tax-bill of $571,894.54 !

2019 World Series of Poker – Main Event: Final Table Tax-Bill

The 2019 WSOP Main event final table payouts combined to total $30,825,000.

The nine lucky players who cashed on the final table of the 2019 main-event can expect to pay a combined tax bill of $11,972,653 – or around 40% of the total prizepool. You can see from the table above that despite finishing in 7th place, Londoner Nick Marchington walks away with more money in his pocket than 6th place finisher Zhen Cai!

Make sure you know about your tax obligations as a gambler, and manage your money and tax-payments appropriately, because the tax-man always wins!

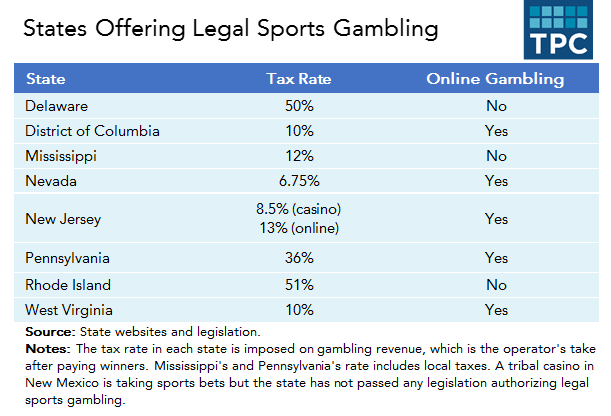

The tax rates for online gambling are literally and figuratively all over the map as jurisdictions across the United States move to approve, regulate – and profit from – mobile/online wagering.

As 2020 begins, there are only three states – Delaware, Pennsylvania, and New Jersey – with regulated online betting on slots, poker, and table games. Nine states across the country, including PA and NJ, have online sports betting.

Here, we break down the various state tax rates for online gambling and discuss the implications of the vast range that exists across markets.

Online casino rates all over the map

Tax rates for online casino operations run from as low as 15% in New Jersey, the top revenue generator, to the 62.5% found in Delaware. That number comes from totaling the state’s cut, referred to as “revenue sharing” in DE, plus a 12.5% state vendor fee.

Pennsylvania took a different approach, varying tax rates depending on the vertical. PA’s rates are 54% for online slots, but 16% for online poker and online table games.

| State | Online Tax Rates |

|---|---|

| Delaware | 62.5%* (50%+12.5%**) |

| New Jersey | 15% |

| Pennsylvania | 54% (slots); 16% (poker & table games) |

*These rates apply after the initial $3.75 million in revenue all goes to the state.

**50% goes to revenue sharing with the state and an additional 12.5% to the state vendor.

Online sportsbook rates run the gamut

Online sportsbook rates vary even more widely across the nine states with mobile sports wagering operational. Those states are:

- Nevada

- New Jersey

- Pennsylvania

- Rhode Island

- West Virginia

- Oregon

- Iowa

- Indiana

- New Hampshire

The lowest tax rate among the online sportsbook jurisdictions is 6.75%, the rate employed in Nevada and Iowa.

The highest, Rhode Island, comes in at a staggering 83% when adding the 51% revenue sharing amount and the 32% cut for the state’s vendor.

Delaware comes in second-highest with its 62.5% tax rate set for online casino.

| States with Online Sportsbooks | Tax Rate |

|---|---|

| Nevada | 6.75% |

| Iowa | 6.75% |

| Indiana | 9.5% |

| West Virginia | 10% |

| New Jersey | 13% (casino-based); 14.25% (racetrack-based) |

| Pennsylvania | 36% |

| New Hampshire | 51% (revenue share) |

| Delaware | 62.5%* |

| Rhode Island | 83%** |

| Oregon | Not disclosed |

*Includes 50% revenue share with the state plus 12.5% to the state vendor

**Includes 51% revenue share with the state plus 32% to the state vendor

Pitfalls of high taxes on online gambling

Nevada was the lone state with full-fledged sports betting prior to the 2018 overturning of PASPA that opened the way for other states to join in. Their reasonable 6.75% tax rate across the board has stood the test of time.

While states like New Jersey, Iowa, and Indiana have followed suit with operator-friendly tax rates, others have clearly opted for a different strategy – to their detriment.

The American Gaming Association (AGA) believes setting tax rates too high to foster competition in the market makes it difficult to compete against illegal gambling operations. The AGA tracks tax rates across the country in the organization’s annual State of the State’s report.

Online Gambling Sites

“To compete with the illegal market, states must implement sensible policies – including tax rates and licensing fees – that enable a seamless shift to safer alternatives for consumers,” said Casey Clark, the AGA’s senior vice president, strategic communications.

Market saturation is changing the gambling business

There is a longstanding tendency by governments to treat gambling taxation as an elastic cash cow, shifting program funding from a state’s voting constituents to outsider companies.

That may have worked when gambling was relatively new, but with the increasing competition in the Northeast and Mid-Atlantic gambling markets, high taxation in certain states has caused issues.

The high online tax rates in Pennsylvania come up when discussing the slowed rate of gambling market growth in the state. The huge 54% slot rate likely in large part explains why there are still just five online slot operators in a state as large and populous as Pennsylvania, with its nearly 13 million residents.

The other factor holding back expansion is likely PA’s decision to require computer servers to be housed within the borders of the Keystone State. This regulation stems from an early 2019 DOJ Wire Act opinion that has been taken at face value by the Pennsylvania Gaming Control Board, even as other states attribute little weight to the interpretation.

With online casino growth left wanting, PA’s online sportsbook market has proven more appealing for operators, despite the hefty 36% tax rate on revenue.

Online sportsbook expansion is ‘hot’

There are currently eight online sportsbooks in PA with more expected to launch in the near future.

Pennsylvania’s online sports betting market has several factors working to their benefit.

Joe Bertolone, the executive director of the International Center for Gaming at the University of Nevada Las Vegas, said online sportsbook growth, even in high tax jurisdictions such as PA, will continue to drive expansion and innovation simply because that niche is considered “hot.”

Despite the high tax rate, the PA market is a “must” for operators due to the size of the state’s population of close to 13 million, added Bertolone.

“You’ve got to be there,” he said of PA.

Small market states feel negative effects of high tax rates

Smaller markets like Delaware and Rhode Island don’t carry the same draw for potential operators. The impact of high tax rates is magnified in these states, which can be further constrained by local law.

While “The First State” was indeed the first in the country to offer a form of legal online casino, revenues from online gambling have underwhelmed to date. In addition to a small population of around 1 million, Delaware is constrained by a law that allows for just three online casino operators, one for each land-based casino.

All three brands operate on one single platform run by 888 Holdings. Competition in the DE market, therefore, is lacking.

The first state (besides Nevada) to launch legal retail sports betting, Delaware is still limited to land-based wagering at their three casinos plus state lottery retailers which can accept parlays of three teams or more.

The state lottery runs Rhode Island‘s only legal online sportsbook, and it has limited features and offers no bonus incentives.

Both states have traditionally treated gambling operations like a goose with limitless gold eggs. But they may soon be forced to change with the times.

Competition necessitates adjustments

After being out ahead of the curve when it comes to offering legal gambling, Delaware seems to be falling behind in adjusting to the post-PASPA era of online wagering.

Between its three casino sportsbooks and lottery retailers, DE brought in $132.5 million in handle for the year 2019, $19.5 million being revenue.

A look at year-on-year figures from 2018 to 2019 in the popular betting month of November, Delaware saw a significant 46% drop in handle while revenue was stagnant at $1.3 million.

With competition in surrounding states increasing, gambling revenues in Rhode Island have also disappointed of late. The Providence Journal reported in November that the state would claim less than $10 million in revenue for sports betting for 2019. That’s less than half of the $22.7 million projected in profit.

The state also now expects only $105 million in handle via the state’s new mobile app, just a fraction of the $595 million assumed in prior projections.

Will high online tax rates survive?

Bertolone has cautioned that expansion is dynamic, and markets will continue to feel the “ripple” as saturation is reached.

Online Gambling Taxation Advice

And yet, just like Delaware, Rhode Island’s tax rate remains in the stratosphere. PA’s rates likewise leave something to be desired, especially for potential online casino operators.

Online Gambling Taxes

Whether states will make changes to online gambling tax rates perceived by many to be unsustainable or stunting growth of the market remains to be seen.